Finansal Tablolar Analizi Dersi 2. Ünite Özet

Cost Of Capital

Introduction

Every business requires capital to invest. Therefore, capital is the most important factor of production and the cost of capital is the most significant determinant in investment decisions. The cost of capital is the average cost of the capital mix (the mix of debt and equity in financing decisions). Firms raise debt and equity in various types which are identified as capital components. The component cost is the required return of the capital component which varies with investors’ risk. In case of debt financing, creditors’ required return mainly changes with the lending horizon and the credit-worthiness of the borrower. In case of equity financing, stockholders’ required return is altered by the riskiness of the investments undertaken by the firm. Managers evaluate capital budgeting decisions according to the firm’s cost of capital. The return from the capital investments should be more than the cost of the capital utilized in financing them. Hence, cost of capital is a major criterion in capital budgeting decisions. If the cost of capital is 10% for a given firm then the return from the capital investments undertaken should at least be 10%. Normally, a business follows a target capital structure, where the percentages of different financing sources are set in an effort to minimize the average cost of capital. The weighted average cost of capital (WACC) is the average cost of the different types of capital employed by the firm.

Cost of Debt

A company may raise debt financing either through bank loans or bond issues. In both types of borrowing the interest rate may be either fixed or floating. If the rate is floating, then an index is used to determine the interest payments for each period. For example, banks borrow from international bank loans at floating rates and the index is almost always the LIBOR (London Interbank Offered Rate). Hence, a Turkish bank borrowing from the international banks pays LIBOR as the base rate and an additional risk premium.

LIBOR is a benchmark rate that represents the interest rate at which banks offer to lend funds to one another in the international interbank market for short-term loans. LIBOR is an average value of the interest rate which is calculated from estimates submitted by the leading global banks on a daily basis.

In bond issues if the interest rate is floating and not fixed, then it is called as an indexed bond. The index can be any economic indicator but mostly it is a price index, such as the inflation rate, the oil price or the gold price index. Apart from indexed bonds, companies may issue convertible or callable bonds. Convertible bonds give the bondholders the right of converting the bonds into common stocks of the company at a predetermined conversion rate. On the other hand, callable bonds give the issuers the right to call back and retire the bonds before the original maturity. Furthermore, there are bonds with sinking funds, whereby a fixed portion of the bond issue is paid back and retired each year until the end of the original maturity.

Cost of Equity

The cost of equity is the return a company requires to decide if an investment meets capital return requirements. A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities.

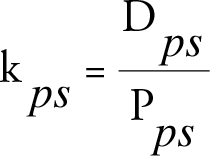

Cost of Preferred Stocks : A business can raise equity capital either through a common stock issue or a preferred stock issue. Preferred stocks are hybrid assets. In some ways they resemble to bonds and in others to common stocks. A preferred stockholder receives fixed preferred dividends that are not tax deductible. Preferred dividends are paid out before the dividends to common stockholders. Thus, preferred stockholders have higher claims on the earnings and the assets of the firm, though they have no voting rights. In this sense, preferred stocks are similar to bonds. But unlike bonds that are issued with stated maturities, mostly preferred stocks are issued without a maturity. Therefore the cost of the preferred stock is:

,where Kps is the component cost of preferred stocks, Dps shows the fixed dividend payments and Pps the price of the security. The above equation is derived from the perpetuity valuation model with fixed cash flows for an infinite time period. As preferred stocks pay fixed dividends for an undefined maturity, the value of a preferred stock is measured by the perpetuity valuation model.

Cost of Common Equity : Common equity financing is raised either by issuing new shares or by retaining the net income earned. The former is external financing while the latter is an internal source. In practice, new equity issues are rare, because companies incur significant flotation costs with new issues which increase the cost of equity to the firm. Moreover, new stock offerings transmit a negative signal to investors depressing the stock price.

If a company retains its earnings instead of distributing cash dividends then it should generate a return on the reinvested earnings at least by the opportunity cost of its stockholders. The stockholders’ opportunity cost is the return they would make from other equally risky investments if they reinvested the cash dividends that are plowed back. Thus, if the firm cannot earn the stockholders’ opportunity cost on the retained income then it should distribute dividends to allow stockholders reinvest earnings at their opportunity cost. To determine the cost of common equity, there are different approaches.

Capital Asset Pricing Model (CAPM) : The CAPM estimates the required return of a stock investment in relation to its systematic risk which cannot be diversified away in a portfolio context.

, where ks demonstrates the required return on any given stock, krf is the risk-free rate of return, km shows the market return and ßs denotes the systematic risk of the stock.

Systematic risk, also known as “market risk” or “undiversifiable risk”, is the uncertainty inherent to the entire market or entire market segment. Also referred to as volatility, systematic risk consists of the day-to-day fluctuations in a stock’s price.

The starting point in calculating the required return is the estimation of the risk-free rate (krf). In real life, there is no totally riskless investment. However in any economy, the securities issued by the Treasury are free of default risk.

Secondly, in CAPM applications the estimation of the market return, hence the market risk premium (MRP) which is the expected market return minus the risk-free rate is essential. The market risk premium (equity risk premium) is the additional return investors require for investing in risky equities rather than low risk debt securities.

Thirdly, the beta of the stock in question is determined. The beta coefficient is the slope of the regression line relating the stock’s returns to market returns. Beta measures the stock’s market (systematic) risk, therefore, the stock’s returns are regressed over the market returns, where the market return is the independent variable and the stock’s return is the dependent variable.

As a final step, after the estimation of all the parameters in the CAPM equation, the required return on the stock is computed, which is the cost of the common equity.

Bond-Yield-Plus-Risk-Premium Approach : The bondyield-plus-risk-premium approach provides a practical but highly subjective solution to the estimation of the cost of equity. The approach is based upon adding up a risk premium over the firm’s bond yield. Thus, the cost of equity is calculated straightforward by a simple computation. However, although the yield on the bond issues of the company is determined in the market, the risk premium that is added over the bond return is an ad hoc figure derived from the analyst’s judgment.

= Bond yield + Risk premium

= Bond yield + Risk premium

A risk premium is the return in excess of the risk-free rate of return an investment is expected to yield; an asset’s risk premium is a form of compensation for investors who tolerate the extra risk, compared to that of a risk-free asset, in a given investment.

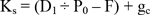

Adjusting the Dividend-Growth Model to Flotation Costs : Firms may also raise external equity capital by issuing new shares. In this case, the firm will have to incur some flotation (transaction) costs which will eventually raise the cost of equity. In order to adjust the cost of equity to flotation costs, we use the following equation:

, where F shows the flotation costs incurred during the issue of the new shares. By incorporating the flotation costs in the model, the rise in the cost of equity after new stock offerings is accounted for.

Comparison of the CAPM, Bond-Yield-Plus-RiskPremium and Dividend-Growth Models : In practice, the overall average of the results from these three models is used as the cost of equity. However, if the results show significant variations, then taking the overall average may not provide a correct estimation. Subsequently, the judgment of the financial analysts would direct the assessment for evaluating a reasonable cost of equity. Unfortunately, we do not have a single method of predicting the exact cost of equity, hence all of these models should be used together within their relative merits.

Weighted Average Cost of Capital (WACC)

Firms maintain an optimal (target) capital mix of debt, preferred stocks and common equity which maximizes its value. Therefore, companies raise new capital according to the target mix of the capital components. The cost of each capital component is weighed at the proportions in the capital structure to quantify the firm’s WACC.

, where WD is the weight of debt financing in the capital structure, KD is the cost component of debt funds, T is the tax rate, accordingly WPS is the weight of preferred stocks, KPS is its cost component, WCE is the weight of common equity and KCE is the cost of equity capital.

The WACC estimation should be based on the market values of the capital components since investors require to be compensated on the full amount of their investments at stake which is the current market value of the investment. Hence, the weights of the capital components should not be computed on book values. Furthermore, investors shape their return expectations at the current market conditions. For that reason, the costs of the capital components are marginal costs (the rate of return on new capital). Investors always require returns at the current market rates no matter if they have invested in the past or they are just newly investing.

In the evaluation of the capital budgeting projects, the WACC of the firm should be used as a decision criterion, nonetheless the investment is financed with a capital mix different than the optimal capital structure. The reason is that all investors have claims on the total cash flows of the firm, without the right of holding separate priority claims on the cash flows of certain projects. In that sense, the investment decisions should be taken in regard of the overall WACC, since the cash flows from the investments should satisfy the requirements of all investors.

Estimating the Marginal Cost of Capital (MCC)

The WACC changes in relation to the variations in the cost of the capital components. The marginal cost of capital (MCC) is the composite cost of the last dollar of new capital raised. The higher the amount of new capital requirements the higher will be the marginal cost to the firm. In order to estimate the marginal cost of capital, firstly the amount of the additional new capital that raises the cost of capital is to be determined. Then the weighted average cost of capital is calculated at that amount of new capital raised.

-

2025-2026 Bahar Dönemi Ara (Vize) Sınavı İçin Sınav Merkezi Tercihi

date_range 11 Şubat 2026 Çarşamba comment 3 visibility 634

-

AÖF 2025-2026 Öğretim Yılı Bahar Dönemi Kayıt Yenileme Duyurusu

date_range 1 Şubat 2026 Pazar comment 3 visibility 383

-

2025-2026 Öğretim Yılı Güz Dönemi Ara (Vize) Sınavı Sonuçları Açıklandı!

date_range 16 Aralık 2025 Salı comment 5 visibility 890

-

2025-2026 Güz Dönemi Dönem Sonu (Final) Sınavı İçin Sınav Merkezi Tercihi

date_range 3 Aralık 2025 Çarşamba comment 3 visibility 876

-

2025-2026 Güz Dönemi Ara (Vize) Sınavı Sınav Bilgilendirmesi

date_range 2 Aralık 2025 Salı comment 2 visibility 731

-

Başarı notu nedir, nasıl hesaplanıyor? Görüntüleme : 26813

-

Bütünleme sınavı neden yapılmamaktadır? Görüntüleme : 15427

-

Harf notlarının anlamları nedir? Görüntüleme : 13612

-

Akademik durum neyi ifade ediyor? Görüntüleme : 13386

-

Akademik yetersizlik uyarısı ne anlama gelmektedir? Görüntüleme : 11165