Introduction to Economics 2 Dersi 4. Ünite Özet

Fiscal Policy And Aggregate Expenditures

Introduction

Government’s role in the economy is discussed in the economics literature within the context of different point of views both in terms of microeconomics and macroeconomics. While the classical economists prefer to consider the government as a unit operating in a restricted environment and not interfering the economy, Keynesian economists put government almost in the middle of the economy and provide with a significantly large area of intervention. Other economic views adopt a midway approach between these two ends. Today, in spite of developments such as globalization and financialization, it is accepted that the government still has a significant role in any economy.

Government in the Economy

Government concept and its role in the economy and tools it uses while performing this role have been discussed for many centuries. The government interferes in economic and social lives by ensuring economic growth and development, providing economic stability and fair income distribution.

On the basis of both local and central administrations, there are factors mostly under direct control of the government as well as some factors out of government’s direct control. Therefore, it is necessary to separate the variables those under government’s direct control and those specified according to economic conditions, thereby not under its direct control. While one of these factors, the income tax rate is determined directly by the government, level of income is determined by households own decisions and preferences (for example preference to work or not) and not under government’s direct control. Similarly, the revenue of corporation taxes is determined according to corporation tax rates and profits of the corporations. Also here, the government determines the corporation tax rate directly, while the profit of companies varies according to many factors and the government has no direct control over the profit of companies.

We have stated after-tax income or disposable income as the basic factor determining the consumption while reviewing households’ consumption expenditures. In order to simplify the model, disposable income is used in three different ways with the assumption that the taxes are autonomous, in other words, they are determined independently from income: Consumption (C), saving (S) and import (IM). If we show disposable income as Yd, we may use the equation below:

Y d = C + S + IM

If we substitute disposable income by its descriptive equation Y d = Y - T, we have

Y - T = C + S + IM

Y = C + S + T + IM

This last equation demonstrates that the total income of the country is being used in four different ways. This income is partly transferred to government as taxes (T), partly used to purchase the domestically produced goods and services, in other words, consumed (C), partly spent for imported goods and services (IM) and partly used for savings (S).

Public or government expenditures consist of total payments against purchase of goods and services made by all public bodies in order to meet the functions undertaken by government. Public expenditure, in a broad sense, includes all expenditures of public institutions and organizations out of budget system, as well as the expenditures within the government budget. From the point of this definition, it includes the sum of general budget and special budgets of all segments of public sector, budgets of regulatory and supervisory authorities, local administrations, funds and social security institutions, floating capital institutions, public economic enterprises and other public institutions.

Autonomous Public Expenditures: When we include total government expenditures in total expenditure flow assuming they are autonomous, in other words, accepting public expenditures being determined independent from the level of income in the country.

Transfer expenditures: Transfer expenditures are the unreturned (outright) expenditures and have no direct effect on the national income. They only cause purchasing power to shift among private individual or social stratums. These shifts are performed unreturned, and there are no changes on the flow of goods and services within national economy. In other words, the transfer expenditures made by public sector do not refer to consumption of real sources. These expenditures transfer purchasing power from public sector to other sectors. Transfer expenditures can be divided into four groups:

- Economic transfers

- Financial transfers

- Social transfers

- Debt payments

Tax revenue, having an important role in government’s total income, is closely connected to societies’ economic, politic, social, cultural and demographic structure. Taxes can be classified in many different ways. The most common classification is the separation of direct and indirect taxes as well as the separation of taxes taken over expenses and wealth.

Fiscal Policy and Level of Equilibrium Income

Government causes an income-increasing effect via expenses it makes and transfers it performs, while it causes an income-decreasing effect via the taxes it collects. On the other hand, the balance between stateoriginated injections (public expenditures) into incomeexpense flow and leakages (taxes) from this flow are very important. Within this context, the state’s use of public expenditures and taxes in order to affect the macroeconomic variables such as employment, income and prices is called as fiscal policy.

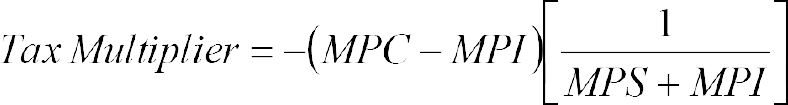

The effect of tax changes on consumption expenditures is determined by subtracting marginal propensity to import (MPI) from marginal propensity to consume (MPC). Increase in consumption expenditures determined according to this difference creates the multiplier effect we have already learned. Thus, the multiplier effect created by any change in taxes can be named as tax multiplier and can be shown with the formula:

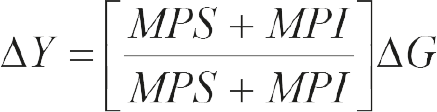

In case of changes in public expenditures and taxes are the same, the numerical value of net multiplier being equal to 1 is called as balanced budget multiplier. Balanced budget multiplier is the net multiplier with a value of 1 when government expenditures and taxes change in the same amount and direction.

Structure of Fiscal Policy

Fiscal policy is a branch of general economy policy. As known, if the tools used to realize the objectives of economic policy are related with public economy, any intervention is defined as fiscal policy. A successful fiscal policy requires adjustments of public expenditures and revenues according to macroeconomic objectives considering their effects on economic variables. Expansionary fiscal policy is the fiscal policy that aims to raise aggregate expenditures by increasing government spending and/or reducing taxes. There are three ways for expansionary fiscal policy: First, the government may decrease taxes that will cause income level to raise by shifting consumption function upward. Second, by increasing public expenditures the government may ensure total aggregate expenditure function to move upward. Third, in order to make the investments to be more profitable, the government may encourage more investments by providing more tax discounts. Contractionary fiscal policy is the fiscal policy that aims to decrease aggregate expenditures by reducing government spending and/or increasing taxes. There are three ways for contractionary fiscal policy: First, the government may increase the taxes. As we saw before, increasing taxes will pull down the aggregate spending by decreasing consumption expenditures, and hence, the level of equilibrium income will drop down toward full employment level, YF . Second, government may cut public expenditures and this will pull down aggregate expenditure function and level of equilibrium income. Third, by changing tax laws government makes it hard for companies to invest.

Fiscal Policy and Economic Stability

In terms of managing all activities in the economy in a stable manner, the absence of primary instabilities such as inflation, unemployment, balance of payments deficit or surplus and the presence of consistently growing GDP are required. This type of environment in the economy is called as economic stability and policies followed for that purpose are known as economic stabilization policy. The main objective of economic stabilization policies is to provide and/or maintain equilibrium in the economy.

Fiscal policy is the entire policies applied by using public sector revenues, expenditures and debts in order to achieve and maintain economic equilibrium or eliminate the disequilibrium in the economy. In developing countries economic stabilization policies are generally used to realize macroeconomic objectives such as improving balance of payments, reducing public sector deficits and decreasing the inflation. The fiscal policy may be implemented in two ways:

- Via automatic stability providers (automatic stabilizers)

- By enabling discretionary policies

The primary automatic stabilizer is the income tax. Of the income taxes, automatic stabilizer characteristic is more clear and also significant in progressive income tax. Taxes collected over income are in the center of a tax system. When production (i.e., income) increases in an economy, total income tax revenue of the government increases as well and vice versa. Another important automatic stabilizer is the unemployment insurance premiums and unemployment benefits. These premiums and benefits (and all similar social security premiums and payments) with their supportive effect on consumption, production and unemployment lower the intenseness of economic downturns.

Besides the above mentioned automatic stabilizers, dividend payments of corporations, savings of households, changes in firm stocks, government budget deficit or surplus can also serve as automatic stabilizers. Operating mechanism of them, apart from government’s specific intervention to the economy, can contribute to automatically balancing of small-scale economic problems. When the scale of economic problems gets bigger, discretionary economic policies have to be used in order to solve them.

-

2025-2026 Bahar Dönemi Ara (Vize) Sınavı İçin Sınav Merkezi Tercihi

date_range 9 Gün önce comment 3 visibility 493

-

AÖF 2025-2026 Öğretim Yılı Bahar Dönemi Kayıt Yenileme Duyurusu

date_range 1 Şubat 2026 Pazar comment 3 visibility 320

-

2025-2026 Öğretim Yılı Güz Dönemi Ara (Vize) Sınavı Sonuçları Açıklandı!

date_range 16 Aralık 2025 Salı comment 5 visibility 825

-

2025-2026 Güz Dönemi Dönem Sonu (Final) Sınavı İçin Sınav Merkezi Tercihi

date_range 3 Aralık 2025 Çarşamba comment 3 visibility 813

-

2025-2026 Güz Dönemi Ara (Vize) Sınavı Sınav Bilgilendirmesi

date_range 2 Aralık 2025 Salı comment 2 visibility 667

-

Başarı notu nedir, nasıl hesaplanıyor? Görüntüleme : 26803

-

Bütünleme sınavı neden yapılmamaktadır? Görüntüleme : 15411

-

Harf notlarının anlamları nedir? Görüntüleme : 13582

-

Akademik durum neyi ifade ediyor? Görüntüleme : 13379

-

Akademik yetersizlik uyarısı ne anlama gelmektedir? Görüntüleme : 11159