Introduction to Economics 2 Dersi Genel Özet

8: Economic Growth And Development

- Özet

Definition and Measurement of Economic Growth

Economic growth is defined as the percentage increase in the value of economic activity from a period to another period of time.

Total production and the Production Function

How much an economy can produce is determined by the productive capacity of the society. The differences in income (output) come from differences in capital, labor, and technology used in production. The production function relates the amount of real output produced with the quantities of factors of production utilized in the economy and it is expressed with the equation (8.2);

Y = A*  (8.2)

(8.2)

where, Y is the real output (Income), A is a number that measures the overall productivity, K is the capital stock, or the quantity of physical capital used the measured period, and L is number of workers used in the production. The  represents the function which relates real output to the capital and labor.

represents the function which relates real output to the capital and labor.

The shape of the production function reveals that there are two main properties of production function;

a) The production function slopes upward, meaning it is positively slope. It indicates that, with given A and L, the more the capital input is used, the more output is produced.

b) The slope of production function becomes flatter as capital input rises. This property says that as the capital input increases by the same amount, the contribution of incremental capital to total output decreases compared previous ones. Thus, the capital input is subject to the law of diminishing marginal product of capital.

The slope of the production function in Figure 8.1 is equal to; slope  . Since

. Since  is equal to the marginal product of capital, then we can say that the slope is equal to

is equal to the marginal product of capital, then we can say that the slope is equal to  . It shows that if capital stock is increased by one unit, how much the total output changes as a result.

. It shows that if capital stock is increased by one unit, how much the total output changes as a result.

Sources of Economic Growth and Growth Models

Proximate and Fundamental Sources of Growth

In the analysis of growth theory, it is useful to separate “the proximate causes of economic growth” from “the fundamental causes of growth”. The proximate causes of economic growth relate the accumulation of capital and labor inputs to the productivity of these inputs. The growth models of the neo-Keynesian Harrod-Domar, neoClassical Solow growth model and endogenous growth theories intended to concentrate on modelling these proximate variables.

However, answers we get from these models about the proximate determinants of growth leave us even with a deeper question of why some countries are so much better than others at accumulating human and physical capital and producing or adopting new ideas and knowledge. In order to give an answer to this question, it is needed to investigate the fundamental determinants of economic growth.

The Harrod–Domar Growth Model

The Harrod–Domar growth model is very simple model to present the determinants of economic growth. The model relates an economy’s growth rate to its capital stock and it emphasizes how positive changes in investment spending causes an increase in an economy’s productive capacity. The model assumes an exogenous rate of labor force growth (n) , a given technology exhibiting fixed factor proportions, namely a constant capital–labor ratio,  and as a result a fixed capital–output ratio,

and as a result a fixed capital–output ratio,  .

.

The Harrod–Domar model assumes that the growth of real GDP is proportional to the share of investment spending (l) in GDP. This implies that for the economic growth, net additions to the physical capital stock are required. Investment is defined as the net additions to capital stock.

The Harrod-Domar model states that the growth rate (g) of GDP is jointly determined by the savings ratio (s) , the capital–output ratio (v) and the depreciation rate of capital stock. The economic growth is positively related to saving ratio, but negatively related to the capital–output ratio and depreciation rate. Also, it indicates that the higher the savings ratio, the faster will an economy grow and the lower the capital–output ratio and depreciation rate, the faster will an economy grow. In case of ignoring the depreciation rate in the Harrod–Domar model, it implies that the growth is positively related to saving ratio, but negatively related to the capital–output ratio.

The Solow Growth Model

The Solow growth model is built on the neoclassical aggregate production function and focuses on the causes of economic growth.

The aggregate production function is assumed to have the properties of; firstly,

- It is positively sloped,

- It is subject to the law of diminishing returns to input.

Second, the production function exhibits constant returns to scale.

Third, as the capital– labor ratio approaches infinity ( k › ?) the marginal product of capital (MPk) approaches zero; as the capital–labor ratio approaches zero the marginal product of capital tends towards infinity (MP k › ?) .

Steady states in Solow Growth Model

In the Solow growth model, the economy reaches a steady-state in the long-run under the assumption of no productivity growth. Steady-state refers to a situation the economy’s output per worker (y t ) , consumption per worker (c t ) , and capital per worker (k t ) are constant over time.

The Solow model concludes that, in the steady state equilibrium, output per worker (y t ) , consumption per worker (c t ) , and capital per worker (k t ) remain constant. However, although there is no intensive growth in the steady state, there is extensive growth because population and the labor input (L) is growing at a rate of per year. Thus, in order for  and

and  to remain constant, both Y and K must also grow at the same rate as population.

to remain constant, both Y and K must also grow at the same rate as population.

Under the assumption of ceteris-paribus, the model implies that the steady state level of output per worker will increase if the rate of population growth and/or the depreciation rate are reduced, and vice versa. The steadystate level of output per worker will also increase if the savings rate increases, and vice versa. Importantly, the Solow model predicts that an increase in the savings ratio cannot permanently increase the long-run rate of growth. A higher savings ratio temporarily increase the growth rate during the period and it also permanently increases the level of output per worker.

The main conclusion of the model is that without technological progress increasing output per worker via capital accumulation is limited. In order to have continuous growth of output per worker in the long-run, the Solow model requires sustained technological progress.

Thus, the model implies that, with no productivity growth, the economy reaches a steady-state, with constant capitallabor ratio, output per worker, and consumption per worker.

The Solow model concludes that the fundamental determinants of long-run living standards are;

- The saving rate

- Population growth

- Productivity growth

The Effect of Changes in the Saving Rate

A higher saving rate means that there is a higher capitallabor ratio, and hence there is higher output per worker, and higher consumption per worker in the Solow model.

The Effect of Changes in the Population Growth

Population growth and as a result the growth in labor force increases the required steady state investment per worker, ( n + d )k from ( n 1 + d )k to ( n 2 + d )k . The Figure 8.10 illustrates the effect of a higher population growth rate on the steady-state capital–labor ratio in the Solow model. The model implies that a higher population growth means a lower steady state capital-labor ratio and hence, a lower output per worker and lower consumption per worker.

The Effect of Changes in the Productivity growth

The Solow model concludes that the key factor in the long-run economic growth is the productivity improvement. The productivity improvement raises output per worker for a given level of the capital-labor ratio.

The Productivity growth, in equilibrium, increases the capital-labor ratio, output per worker, and consumption per worker. The productivity improvement directly improves the amount of output that can be produced at any capital-labor ratio. This means that the productivity growth increases the output per worker and the increase in output per worker increases the supply of saving, causing the long-run capital-labor ratio to rise.

Augmented Solow Growth Model

Mankiw et al. (1992) and Mankiw (1995) developed the augmented the Solow model by adding the accumulation of human capital to the initial variables. Adding human capital to the model, the production function becomes:

Y = K a H ß ( AL ) 1-a-ß

where H is the stock of human capital and AL is the labor input measured in efficiency units, which captures both the quantity and the productivity of labor. It is assumed that the production function exhibits constant returns to scale and since a + ß < 1, there are diminishing returns to combined capital of labor and physical capital.

In the augmented model, since there is a larger capital share  , the average product of labor declines more slowly as accumulation takes place. The reason that the average product of labor declines more slowly because the size of the capital share determines the slope of the production function and hence the speed of diminishing returns.

, the average product of labor declines more slowly as accumulation takes place. The reason that the average product of labor declines more slowly because the size of the capital share determines the slope of the production function and hence the speed of diminishing returns.

Augmenting the Solow model with human capital, the economy reaches to the steady state much slower and most of international differences in living standards can be explained by differences in the rate of population growth and the accumulation of both human and physical capital.

Endogenous Growth Models

In these models, economic growth and the growth of income per capita depends on broad investment rather than unexplained technological progress as the Solow model concludes. The term investment refers to a broader concept that not only includes the physical capital accumulation, but also includes research and development (R&D) expenditures and human capital formation.

The models assume constant returns to broad capital accumulation. The concept of capital includes both the investment in knowledge and the accumulation of physical capital.

In Rebelo (1991), the endogenous growth model is the AK* model shown in equation below:

Y = AK a H ß = AK*

Here A is a constant, K* represents a broad measure of capital ( K a H ß ), and a + ß = 1. The model implies that there are no diminishing returns and hence no reason for growth to slow down as capital accumulation occurs. Further, it implies that the countries with higher average savings rates, lower depreciation rates and lower capital– output ratios will grow faster than the countries that have not these conditions.

In the Solow model, the saving rate does not affect the long-run economic growth rate and growth rate of output per worker. The outcome about the effect of changes in saving rate is different in the endogenous growth models (AK models).

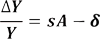

The term,  , is the growth rate of output. The equation implies that the growth rate of output depends on the saving rate positively and depreciation of capital negatively. Thus, the saving rate affects the long-run economic growth rate in the AK model. The theory attempts to explain, rather than assume, the economy’s growth rate. It concludes that the growth rate of the economy depends on the saving rate that can be affected by government policies.

, is the growth rate of output. The equation implies that the growth rate of output depends on the saving rate positively and depreciation of capital negatively. Thus, the saving rate affects the long-run economic growth rate in the AK model. The theory attempts to explain, rather than assume, the economy’s growth rate. It concludes that the growth rate of the economy depends on the saving rate that can be affected by government policies.

Suggested government policies to raise long-run living standards

The determinants of long-run economic growth are the rates of accumulation of human and physical capital together with sustained technological progress. What kind of government policies are necessary to affect a nation’s long-run growth and development progress? The theory suggests that there is a need to improve saving rates and productivity growth by using government policies.

If the private market is efficiently working, then the government should not try to change the saving rate by changing the policies since the saving rate determined by the market. However, if there exists inefficiently low level of saving in the economy, the government policy to raise the saving rate may be justified. Saving rate can be increased by raising the real interest rate. Another way is to increase national saving is to increase government saving. This is only possible if the government could reduce its budget deficit or government is running a surplus in its budget.

There is a link between improved infrastructure and productivity. Improving infrastructure includes the construction of new highways, bridges, utilities, dams, airports, etc. Also, there is a strong connection between productivity and human capital formation. The government can encourage human capital formation through educational policies, worker training and relocation programs, and health programs. Finally, encouraging research and development (R&D) increases productivity. The government can encourage (R&D) through direct aid to research.

Economic Development

Economic development is a broader concept than economic growth. Economic development reflects social and economic progress and requires economic growth. Economic growth is a vital and necessary condition for development, but it is not a sufficient condition as it cannot guarantee development. In general, economic development is the improvements in standard of living through the creation of jobs, the support of innovation and new ideas, the creation of higher wealth, and the creation of an overall better quality of life. Improvements in; (i) infrastructure such as roads, bridges, etc.; (ii) education system through new schools; (iii) public safety through fire and police service are also the requirements of the economic development. If there are improvements in average income of families, local unemployment rates, standardized testing and literacy results in children, leisure time and changes in life expectancy, or hospital stays, then we understand that the economic development is working.

Indicators of Economic Development

The extent to which a country has developed may be assessed by considering a range of narrow and broad indicators, including per capita income, life expectancy, education, and the extent of poverty. The most known development indicator is the Human Development Index (HDI) which was introduced in 1990 by the United Nations to provide a means of measuring economic development in three broad areas; per capita income, health and education. The introduction of the index was an explicit acceptance that development is a considerably broader concept than growth, and should include a range of social and economic factors.