Introduction to Economics 2 Dersi 2. Ünite Özet

Determination Of National Income

- Özet

- Sorularla Öğrenelim

Introduction

While economies experience rapid increases in production for a certain period, they also suffer serious contractions in production for other periods. This is a valid economic reality for all economies. In this chapter, we will try to find an answer to the question of why economic recession emerges in a few years after an economy experiences a certain period of prosperity. Naturally, fluctuations in economic activity are also a determinant for other macroeconomic problems such as unemployment and inflation. We need to know how the level of production or income in a country is determined so that we can understand the causes of these problems and their solutions. For this purpose, we will examine in detail the factors (other than price level) that determine expenditures in a country.

The assumption that prices are constant means that the level of total production in the country is infinitely flexible. According to this Keynesian approach, there is always an idle capacity to meet the increasing demand in the economy. This means that the level of production will be determined by demand (the effective aggregate demand), in other words by aggregate expenditures. The assumption that prices are constant also means that there is an unemployment and idle production capacity in the economy. In such an environment, firms can increase production by employing more workers without incurring any additional cost and this does not exert any pressure on prices to increase.

Consumption and Saving

Households use the income they earn in three different ways. They can spend their income for the consumption of goods and services, saving money and paying taxes.

The main factor determining the consumption expenditures to be made in a given period is the income level. Along with the increase in income, the desire and purchasing power of households to make consumption expenditures also increases. This linear and positive relationship between income and consumption expenditures is called consumption function. Consumption function refers to the positive linear relationship between income and consumption expenditures. The consumption function is the most important component of the modern macroeconomic theory. Consumption function is widely used by economists to predict an economy’s progress and the behavior of economic agents. Saving function also refers to the relationship between income level and savings. If a household spends more than its income, it has to cover the excess of expenditures by borrowing or using the savings made before. This is called negative saving.

Consumption expenditures are composed of the sum of autonomous consumption and consumption expenditures related to the income (induced consumption). As we discussed above, an increase in the level of income also increases consumption expenditures related to income. This relationship between the change in income and the change in consumption is called marginal propensity to consume (MPC) and is defined as the ratio of consumption change to income change:

The marginal propensity to consume is a concept of how much consumption will change when income changes. Similarly, marginal propensity to save (MPS) reveals the relationship between the income change and the saving change and is calculated as the ratio of the saving change to the income change:

MPC and MPS remain constant at each level of income. This is the result of the linearizing consumption and saving functions. On the other hand, the sum of marginal propensity to consume and marginal propensity to save has to be equal to 1 since the income that is earned must be consumed or saved:

MPC + MPS = 1

Instead of analyzing what proportion of income change is devoted to consumption, we may be interested in how much of the income is consumed and saved. In order figure out these ratios, we need to use the concepts of average propensity to consume and average propensity to save. Average propensity to consume (APC) is the portion of income that is spent for consumption. Average propensity to save (APS) , on the other hand, is the portion of income that is saved :

In fact, if we know one of the APC or APS values, there is no need to calculate the other. The income earned should be consumed or saved. For this reason, the sum of the portion of consumption divided to income and the portion of savings divided to income has to be equal to 100 percent. This also means that the sum of these two ratios must be equal to 1:

APC + APS = 1

There are different factors that influence the consumption decisions of households. Some of these factors are not related to income. The main factor that determines consumption expenditures is income level and there is a positive relationship between consumption and income as indicated by the consumption function. Another important factor for determining consumption is the expectations about future income, prices and wealth. For example, if consumers expect a stagnation in the economy, they expect that they will lose their jobs or their working hours will be reduced. In this case, they will reduce their consumption expenditures and therefore they will save more. Other factor is the wealth. Wealth is the monetary value of all assets that households have. When the wealth of households increases, the available resources that can be allocated for spending increase, too. While the other factors effecting consumption are assumed to be constant, an increase in population will increase consumption expenditures. Considering the age composition of the population, it is known that the young population spends more on durable consumption goods and therefore the young population has a higher marginal propensity to consume than the elderly population. Since the slope of consumption function is measured by MPC, the rising share of the young people in total population will make consumption function steeper.

Investments

Investment expenditures cover the expenses incurred by firms in capital goods and inventories. Among the aggregate expenditures, investments are the most volatile one. When examining the determination of national income in an economy, we will assume that the investments are autonomous to simplify the analysis, i.e. independent of the current income level.

Investment expenditures are made up of expenditures of firms on capital goods and stocks. Capital goods are the equipment they need to carry out production activities and the buildings that firms have. Stocks are composed of final unsold goods. Stocks may be planned or unplanned. Planned inventory investment is the planned change in stocks. Unplanned inventory investment is the unplanned change in stocks.

The main factor determining whether an investment is profitable is the interest rate. Interest rate can be defined as the cost of borrowing funds. The other factor that determines the amount of investment is the expected profitability of investment. One of the main driving forces behind new investments is technological change. Technology is important for companies as it increases productivity at each stage in production processes. The use of technology also contributes to a reduction in production costs. Another factor that affects investment expenditures is the cost of capital goods. As the price of capital goods increases, the expected profitability of the investment will decrease and a contraction in investment volume will occur. If a firm intensively uses the capital stock that it owns, it will want to add that stock. when the capacity utilization rate is low investment expenditures will also tend to decrease.

Government Expenditures

Government expenditures are included in the aggregate expenditure function with the assumption that they are autonomous. The reason for this is that the government expenditures to be realized in the current year are determined in the public budget of the previous year. We will also assume here that the expenditures made by the government for goods and services purchases are independent of the current income level in the country, i.e., public expenditures are autonomous.

Net Export

The last component of aggregate expenditures is net export, showing net expenditures between countries. Net export is the difference between revenue obtained by exporting goods and services to foreign countries and payment made by importing goods and services from foreign countries. If net exports take a positive value, the country has a surplus in foreign trade. If net exports have a negative value, the country will have foreign trade deficit.

The sale of goods and services produced in a country to other countries is called export. There are a number of factors that determine the export volume of a country. These include income levels, preferences and prices of similar goods in other countries. Limitations that governments put on international trade and the exchange rates can also affect the export volume. However, since exports are independent of the current domestic income, we will regard exports as autonomous.

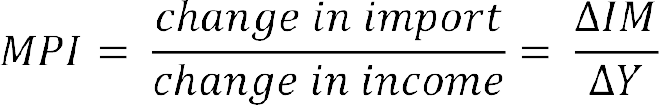

The amount of goods and services purchased from other countries is called imports. The amount of imports is also determined by preferences, restrictions imposed on international commercial activities and exchange rates. However, the income level of the home country is also important here. The increase in the income level of the home country has a positive effect on demand of foreign as well as domestic goods. By using the concept of marginal propensity to import, we measure the extent to which the amount of imports changes depending on the changes in income. The marginal propensity to import (MPI) is the ratio of the change in import to change in income:

Aggregate Export Function

The aggregate expenditure function is obtained by summing up each of the planned expenditure functions described above. Aggregate expenditures (AE) are composed of consumption (C), investment (I), government expenditure (G) and net export (NX):

AE = C+ I + G + NX

According the macroeconomic equilibrium concept, aggregate expenditures play a key role for the determination of production and income level of a country.